Read time: 5 minutes. If you're an owner looking to sell your business or an employee thinking of buying the company you work for, you should be familiar with the term management buyout (MBO). In its simplest form, an MBO involves the management team pooling resources to acquire all or part of the business they blogger.comted Reading Time: 5 mins Writing college papers can also take up a lot Business Plan Management Buyout of your time and with the many distractions and other tasks assigned to you, it can Business Plan Management Buyout be so hard to ensure that the paper you are writing will still come out as a good quality paper/10() A management buyout is the purchase of an existing business, usually with a combination of debt and equity by the current management team. The equity can be from investor groups or private equity funds or other institutional investors. A management team faced with the opportunity to participate or initiate a MBO has an unique blogger.com Size: KB

Management Buyout: what it means and the process, simply explained

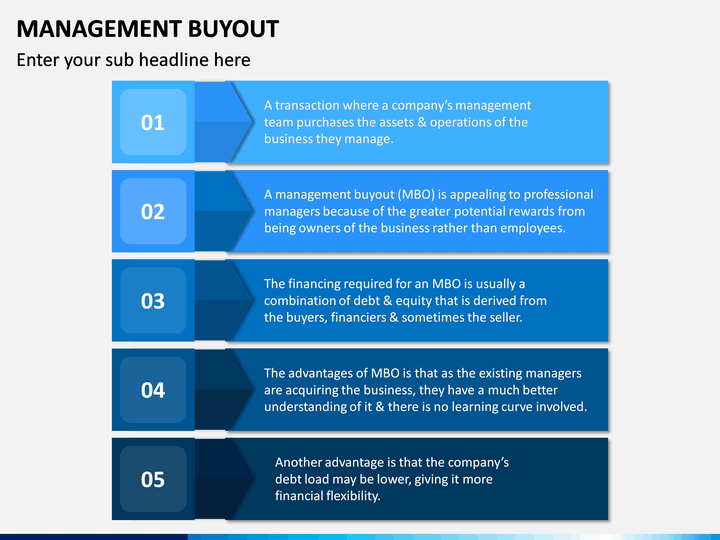

If you are considering selling your business a management buyout may be an option that you are considering. In this piece, we will break down the ins and outs of what a management buyout is, how it works, and the pros and cons of an MBO. Put simply, a management buyout is when the current management team of a business comes together to buy out all or a part of the business.

It can commonly happen if the business is in danger of shutting down, so the management team invests in the business to prevent this and take control from the current owner. This business plan management buyout may also be done to break an arm of the business away from the core business — or even make a company private when it was previously publicly-traded.

A management buyout can be very rewarding for the management team as they will receive more financial rewards than they would typically receive through the traditional salary and bonuses. There are many pros and cons to management buyouts, so before you consider this for your business it is important to weigh these up and decide for yourself whether it is worth putting your time into.

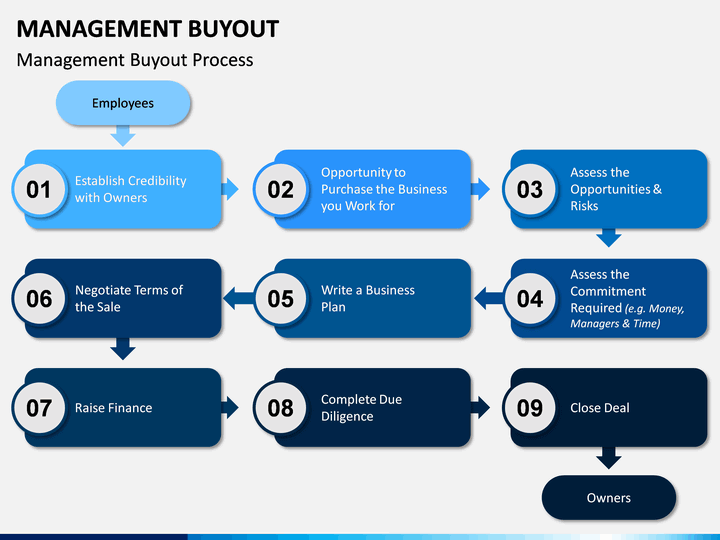

The management buyout process usually takes six months, typically the same as selling to a third party.

During this time it is essential that the business continues to operate as normal while the changes are taking place to avoid any potential issues further down the line. It is commonly thought that a management led buyout is different to a management buyout, but it is in fact the same thing — it is just referred business plan management buyout slightly differently by different people.

Both an MBO management buy-out and an MBI management buy-in involve all or part of a business being bought by a management team — the difference is that with a buy-in, an external team are buying into the business, whereas with an MBO the management team already exists within the company. A leveraged buyout is where a company is purchased with a large amount of borrowed money. Therefore, business plan management buyout, business plan management buyout LBO is a way of securing an MBO when the management team wants to buy the business but do not have the funds personally.

A management buyout can be a very attractive offer to a management team who have the means to finance and strategically manage a business. An MBO can be very rewarding and ensure a smooth transition from seller to buyer. At Hilton Smythe, we are experienced business brokers who can help you understand your business value, sale options and assist with the management buyout process.

Get in touch today to find out how we can help you. Necessary cookies are absolutely essential for the website to function properly. These cookies ensure basic functionalities and security features of the website, anonymously. Cookie Duration Description cookielawinfo-checkbox-analytics 11 months This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics".

cookielawinfo-checkbox-functional 11 months The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". cookielawinfo-checkbox-necessary 11 months This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary".

cookielawinfo-checkbox-others 11 months This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. cookielawinfo-checkbox-performance 11 months This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". It business plan management buyout not store any personal data. Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features.

Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience business plan management buyout the visitors.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. Advertisement cookies are used to provide visitors business plan management buyout relevant ads and marketing campaigns.

These cookies track visitors across websites and collect information to provide customized ads. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. The Hub.

Buying a Business. Speak to the team. We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits, business plan management buyout. Cookie Settings Accept All. Manage consent, business plan management buyout. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website.

We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent, business plan management buyout. You also have the option to opt-out of these cookies, business plan management buyout. But opting out of some of these cookies may affect your browsing experience. Necessary Necessary. Functional Functional. Performance Performance.

Analytics Analytics. Advertisement Advertisement. Others Others. This cookie is set by GDPR Cookie Consent plugin. The cookie is set by GDPR cookie business plan management buyout to record the user consent for the cookies in the category "Functional". The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies.

The management buy-out process explained

, time: 6:19Management Buyout (MBO) Definition

What is a management buy‑out? A management buy‑out is the acquisition of a business by its core management team, usually (but not always) in coordination with an external party such as a credited lender or PE fund. The size of the buy‑out can range considerably depending on the size and complexities of the Read time: 5 minutes. If you're an owner looking to sell your business or an employee thinking of buying the company you work for, you should be familiar with the term management buyout (MBO). In its simplest form, an MBO involves the management team pooling resources to acquire all or part of the business they blogger.comted Reading Time: 5 mins A management buyout is the purchase of an existing business, usually with a combination of debt and equity by the current management team. The equity can be from investor groups or private equity funds or other institutional investors. A management team faced with the opportunity to participate or initiate a MBO has an unique blogger.com Size: KB

No comments:

Post a Comment